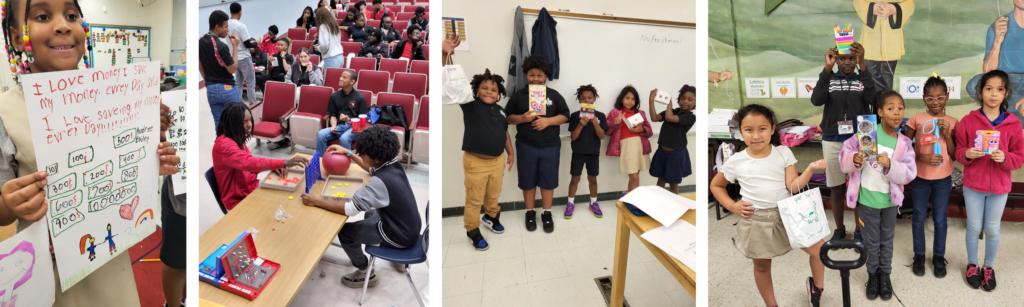

Financial literacy is often overlooked in mainstream education, yet it is a vital skill that can significantly influence an individual’s lifelong outcomes. That is why Twyla Prindle introduces financial education to children as young as seven in her innovative and transformative financial literacy programs. Twyla is the CEO and founder of Us & Our Children Inc. and the visionary behind Kash Kids and Prindle House Publishing. We were introduced to Twyla’s work through a skills-based volunteering program organized by Common Impact and Fidelity Investments.

Twyla Prindle has authored over 25 insightful children’s books, primarily focused on financial education for young readers. Among her notable works is the best-selling book Where Is My Money? – a testament to Twyla’s dedication to instilling financial literacy and entrepreneurial skills in young children. As a distinguished speaker, Twyla Prindle’s wealth of knowledge and expertise is instrumental in transforming financial education for the next generation.

We are excited to delve into Twyla’s journey and her experience with skills-based volunteering, gaining valuable insights into her remarkable dedication to empowering the youth.

Studies show that kids between 7 and 11 have learned most of the behaviors that will set them up for life. That’s why I focus on working with young students to ensure they get those important life skills as early as possible.

What inspired you to delve into the world of promoting financial literacy and entrepreneurial skills for children?

My dad instilled a strong sense of financial literacy in me from a young age. I started managing my money with a simple zip bag for collecting my allowance. Then, my grandma introduced me to her Christmas Savings Club, a tight-knit group of ladies who helped each other save up for the holidays. Everyone in the club would save a certain amount of money each month. These key experiences helped me learn how to save money towards a goal. For me, it was about saving enough to buy my parents gifts for Christmas.

However, when I went to college, I fell into the trap of accumulating $44,000 of credit card debt. This debt had consequences beyond my expectations, including losing a job offer due to poor credit. It was a wake-up call. So, I rolled up my sleeves and spent the next two years paying off my debt, leaning on the financial lessons I learned in my childhood. For two years, I only spent money on life’s necessities and put the extra money towards paying my credit card debt. As I progressed, I assisted friends facing similar challenges, relying on my financial literacy skills to support them. I showed them how to track their money habits and budget and adopt good financial habits such as saving.

That is when I got the idea to start teaching kids about money. The earlier people learn about personal finances, the better. I kicked things off with a summer camp and started writing children’s books about money almost immediately. By addressing common financial misconceptions through storytelling and workshops, I have made a tangible impact on the financial literacy of young students across Jacksonville, Florida.

What are the benefits of teaching children financial literacy at a young age?

Studies show that kids between 7 and 11 have learned most of the behaviors that will set them up for life. That’s why I focus on working with young students to ensure they get those essential life skills as early as possible. Beliefs about money are already deeply ingrained by their high school years, so it is imperative to ensure that children have a solid grasp of fundamental money math skills that will support them in everyday decision-making.

What are the challenges of running a nonprofit?

A significant challenge in nonprofit work is securing funding, especially for staffing. While funders often support program initiatives, they may not fully cover staffing costs, posing a key challenge for sustainability. It is a constant balancing act of securing operational funding and ensuring we have the staff to lead programs. Without our staff, we cannot run our programs as effectively, so ensuring sustainable funding for staff salaries is crucial for our organization’s longevity.

Many schools and organizations where we run our programs prefer consistent personnel over volunteers. Initially, due to limited resources and capacity, we had a waitlist for our programs. However, over time, we expanded our capacity and streamlined our operations to accommodate more participants and improve financial literacy for students in Jacksonville, Florida.

Could you share your overall experience participating in skills-based volunteering events with Common Impact and Fidelity?

Through Common Impact and Fidelity’s skills-based volunteering programs, I gained valuable insights and forged meaningful connections with Fidelity volunteers. The support of Fidelity skilled volunteers has been instrumental, especially in navigating complex initiatives like generating a fundraising strategy to fund our augmented reality website, which we hope to launch in late 2024. Access to industry professionals has been invaluable. They have helped bridge gaps in my understanding when selecting vendors to build the virtual learning environment I envision for my students. Each interaction leaves me inspired and better -equipped to navigate the ever-evolving landscape of our digital world.

You participated in multiple skills-based volunteer programs with Common Impact and Fidelity Investments. Tell us about the projects you’ve collaborated on with Fidelity skills-based volunteers.

Kash Kids previously worked with a Fidelity team through a Flash Consulting event where we received a vendor selection framework for selecting a virtual learning platform to host what will be called Kash Kids World, where learning financial skills is fun and engaging for youth. We then worked with a team of different Fidelity volunteers to help us flesh out our vision for the platform and the roadmap for the product. The Kash Kids World project has a high price tag, and we need a multi-faceted fundraising strategy. Our latest skills-based volunteering addressed our need for guidance on a membership model, cultivating corporate sponsorships, and hosting a virtual gala.

Our projects involved a diverse team with various skill sets every time. For example, one member excelled in strategic planning; they took the lead on helping map out a proof of concept of Cash Kids World – we envisioned an interactive platform where students engage with animated characters from our books on a virtual journey learning financial literacy skills along the way. The volunteers translated my ideas into a structured process map to help Kash Kids developers create the site with the capabilities we want.

Part of our vision for Cash Kids World is to enable students to scan bar codes printed in Kash Kids books with their phones and tablets to access interactive lessons on topics like the stock market, budgeting, savings, and more. Another feature the volunteer suggested I am particularly excited about is the ability for kids to track their progress directly on the site by creating an account.

Each member contributed unique skills and perspectives to bring the Kash Kids World proof of concept project to life. This roadmap will be key in helping secure the funding to make our vision a reality. Having access to a skills-based team of volunteers expanded my vision to new possibilities!

Can you share specific outcomes or changes that resulted from implementing the volunteer’s recommendations?

During my third project with Fidelity skills-based volunteers, we focused on mapping out a fundraising plan. One key recommendation was to assemble a team of five staff members to kickstart the planning process. Following that advice, I brought on board a fundraising consultant, and we’ve been diligently working behind the scenes since November 2023.

Our efforts have progressed steadily, with monthly meetings and a growing fundraising team. As we move forward, we are transitioning to actively securing larger donations. We are proactively engaging in the fundraising process to diversify our financial support and ensure the sustainability of our initiatives. We have leaned heavily on the action steps the Fidelity volunteers created for us to guide us as we implement the new fundraising strategy.

Could you share any exciting upcoming projects or initiatives?

We launched a program called Elves in Business to teach kids about entrepreneurship. As part of our Kash Kid financial literacy program, we organized a field trip to a local business center where children interacted with entrepreneurs and engaged in group discussions. The experience was a hit, with both the business center and schools expressing interest in turning it into a recurring program. Now, we are formalizing Elves in Business as part of our regular programming to expose them to conversations about money with professionals who are doing the work!

Additionally, we’re enhancing our programs by empowering kids to choose activities beyond financial literacy. For instance, we recently organized a video game tournament that was entirely planned by the students. This initiative has significantly increased attendance at our Friday night gatherings. These gatherings are intended to provide a space where our members can create connections and build community with like-minded children and parents.

What advice would you give to aspiring social entrepreneurs looking to make a positive impact?

Volunteering or working in a field related to your interests is invaluable. People often try to reinvent the wheel, but joining existing initiatives and contributing your unique perspective is sometimes more effective. Secondly, finding a mentor, whether in person or through books, can provide valuable guidance. One of my mentors once shared a piece of advice that stuck with me: “What is your next affordable step?” This phrase reminds me that our resources are often closer than we realize, and we should identify and leverage them.

Twyla Prindle’s journey exemplifies the transformative potential of financial education, demonstrating that empowering young minds with essential life skills can pave the way for a brighter, more prosperous future. Twyla underscores the importance of knowledge sharing and exemplifies that by embracing the power of skills-based volunteering. Skills-based volunteers helped propel her mission forward in tangible ways, such as innovating Kash Kids World and guidance on fundraising strategies. Skills-based volunteering can help nonprofits do more good in communities by boosting their operational capacity.

Consider supporting Kash Kids by donating or reach out.

For more social impact content like this, follow us on LinkedIn and sign up for our monthly newsletter. Ready to learn more about skills-based volunteering or social impact programs for your company? Reach out.